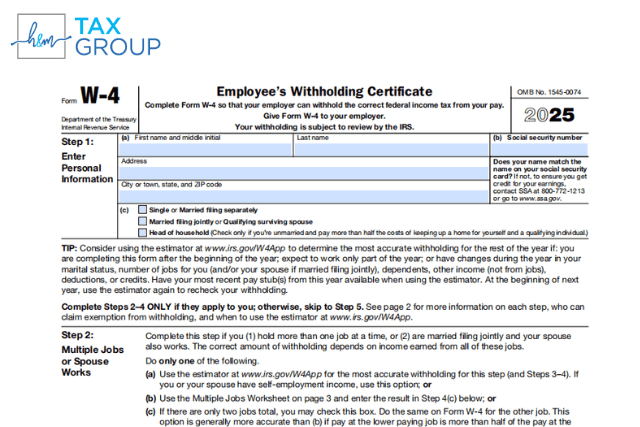

Starting a new job comes with plenty of paperwork, but the first form that you encounter is the IRS W-4 Form, also known as the employee withholding certificate. Completing this form correctly has a high impact on your finances and yearly taxes. But why does it matter?

This W-4 form tells your employer how much federal income tax to withhold from your paycheck every year. If you complete it correctly, you can avoid penalties and may receive a refund as your take-home pay. W-4 form updates every year. Therefore, it is important to use the updated version to complete the form. This guide will help you understand exactly what the W-4 Form is, how to fill it out correctly, and what mistakes to avoid.

What is a W-4 Form (employee withholding certificate)?

When you start earning money as an employee, the IRS expects you to pay taxes. To ensure you withhold the right amount of money for taxes, you have to complete some paperwork, especially the Form W-4. This form will specify how much you earn, your source of income, your filing status, and what federal income tax credits you qualify for.

Once you complete this form, it will help your employer calculate the amount of federal income tax to deduct from your salary and send to the IRS. If you pay less than what you owe, you might face a tax penalty from the IRS. If you overpay, you will get a refund when you file your tax return. Completing this form on time and outlining all information accurately will ensure you don’t overpay or underpay.

Why do I need to fill out the W-4 form?

-

Avoid tax penalties next tax season.

When you submit the correctly filled form on time, this ensures your next paycheck shows your true tax situation. If you hold too much, you may get a refund, or when you hold too little, you may face serious penalties. When you do it right, you will have full control over your finances.

-

Adjust to significant life changes.

When you get married, get divorced, buy or sell a house, this has a huge impact on your taxes. When you update your W-4 Form after these events, your employers will be able to adjust your withholding accordingly, so you don’t have to face tax challenges.

-

Default withholding rules

If you don’t submit the updated form on time, the IRS allows the employer to use the default setting, which is filing as single with no adjustments. This means extra money would be deducted from your paycheck.

-

Updated Payroll tax form

Once you update your W-4 Form, your employer must implement and update your payroll tax form within one or two pay periods.

How to fill out a W-4 Form?

Here’s a step-by-step guide on how to fill out your Form W-4 correctly when you start a new job in Dallas or adjust to any life events.

- Fill out your personal information.

First, provide your personal information, including your name, tax filing status, social security number, and address. This will determine your basic withholding tax rate.

- Account for your additional job and your spouse’s job

If you and your spouse work multiple jobs, your combined income might place you in higher tax brackets. In such cases, you can use the IRS Tax Withholding Estimator online or use the sheets with this form to calculate the right adjustment.

- Claim dependents

You can claim child tax credits for up to $2000 for a child and $500 for other dependents if your income is up $200,000 if you are filing separately or up to $400,000 if you are married filing jointly.

- Make additional Adjustments

You can use this section if you have another income, deductions you qualify for, or additional withholdings you want your employer to keep from your paycheck.

- Sign & Date

Once you have provided all the required information, you must sign and date your form. Without your signature, your form is not valid.

If you are confused about filing out your W-4 form, you can hire a tax expert to file your form correctly to avoid any mistakes. Having a Tax advisor from H&M Tax Group means a local tax expert will do your taxes from start to finish as per your unique financial situation.

How to fill out a W-4 form as an employer?

When the employee completes and submits the form, the HR representative or employer must fill out the section labeled “For employers only”. You, as an employer, must provide the following information:

- The company’s name and address. If your company has multiple locations, you can either add the head office address or the one where the person is hired.

- Add the employee’s date of employment and Employer Identification Number.

Once you complete your part, your responsibility would be to update the employer tax adjustment and information correctly in the system and to calculate the right tax withholdings from the paycheck.

When should I update my W-4 Form?

You can update your W-4 form anytime, especially when you:

- Get married or divorced

- Welcome a new child or a dependent

- Start or end a new job

- Start freelancing or receive a raise

- Buy a home

Final Thoughts

Filling out the W-4 form correctly and on time can save you from tax penalties during tax season. At H&M Tax Group, our team of certified tax consultants provides you with a step-by-step guide to file your taxes and update your W-4 form. Our goal is to help you keep most of your income and maximize your refund while staying IRS compliant.