What is the purpose of the W-4 form?

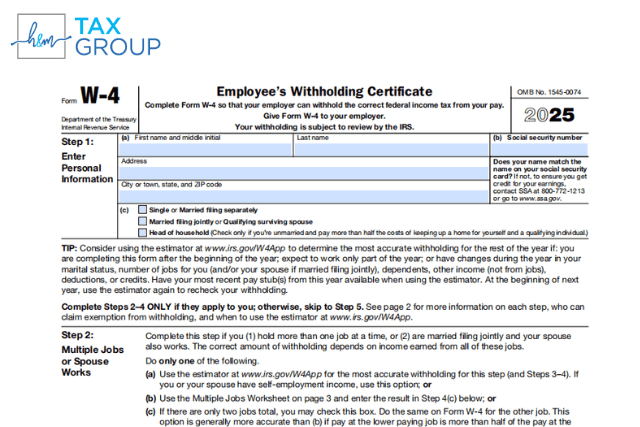

Starting a new job comes with plenty of paperwork, but the first form that you encounter is the IRS W-4 Form, also known as the employee withholding certificate. Completing this form correctly has a high impact on your finances and yearly taxes. But why does it matter? This W-4 form tells your employer how much […]

What is the purpose of the W-4 form? Read More »